Casual hourly rate calculator

The Hourly salary calculator for. Use our calculator to check your base pay rate and the weekend penalty rates youre entitled to whether youre a permanent or casual retail worker.

Hourly Rate Calculator

This is equal to 37 hours times 50 weeks per year there are 52 weeks in a year but she takes 2 weeks off.

. First calculate the number of hours per year Sara works. The ordinary hourly rate is made up of. Your salary - Superannuation is paid additionally by employer.

An employee earns 19362 and claims tax offsets of 500. Hours Paid Year. The average hourly pay for a Casual Worker is 1503.

There are two options. No bad debts no serious. 2 There are not other additional levies.

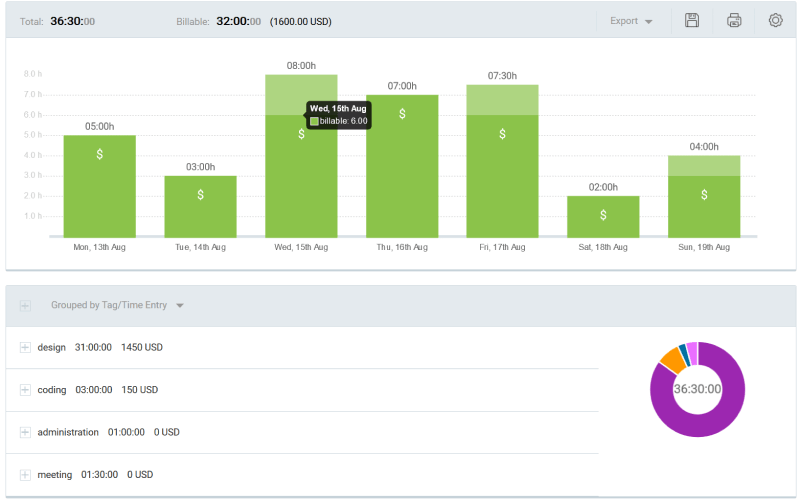

That assumes that you get 5 hours billable work everyday of every working week year in year out. Ordinary Casual Hourly Rate. For example for 5 hours a month at time and a half enter 5 15.

Overtime rates are calculated on the ordinary hourly rate. KiwiSaver Employer Contribution Year. The average hourly pay for a Casual Worker is 1503.

Find out the benefit of that overtime. Hours Health Leave Year. To calculate annual salary to hourly wage we use this formula.

A project manager is getting an hourly rate of 25 while working 8 hours per day and 5 days a week. If you get paid bi-weekly once every two weeks your gross paycheck will be 2308. Hours Annual Leave Year.

To calculate annual salary to hourly wage we use this formula. Subtract the daily value of the tax offsets from the amount found in step 1. 37 x 50.

On this calculator that gives you a charge of 54 per billable hour. Different rates are used to calculate overtime and penalty rates for casuals. Under awards and agreements casual employees are also paid a casual loading a higher pay rate for being a casual employee or a specific pay rate for being a casual employee.

Hourly wage 2500 Daily wage 20000 Scenario 1. Learn about workplace entitlements and obligations for sick and carers leave COVID-19 vaccinations PCR and rapid antigen testing and more. The calculator will work out pay rates hourly and weekly penalty rates casual rates allowances shift work overtime and public holiday rates all based on the industry and.

Hours Annual Leave Year. The calculation on the Medicare levy assumes you are single with no dependants. For example if a casual worker is paid the current national minimum wage of 2138 per hour and their Award or Enterprise Agreement stipulates a casual loading rate of 25 the.

Enter the number of hours and the rate at which you will get paid. Yearly salary 52 weeks 375 hours per. His income will be.

3 You are entitled to 25000 Low Income Tax Offset. Ignore cents input 193 into the Withholding. Hours Worked Year.

Take home pay 661k.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Markup Calculator Omni Calculator Sales People Omni

Gst Calculator How To Find Out Goods And Service Tax Tax Refund

Hourly Rate Calculator

Salary To Hourly Salary Converter Salary Hour Calculators

Salary To Hourly Paycheck Calculator Omni Salary Budget Saving Paycheck

Margin Calculator Calculator How To Find Out Calculators

Employee Cost Calculator Updated 2022 Employee Cost Calculation

Real Hourly Wage Calculator Nerdy Humor Teacher Humor Work Humor

Overtime Calculator

Hourly Rate Calculator

Employee Cost Calculator Updated 2022 Employee Cost Calculation

Employee Cost Calculator Updated 2022 Employee Cost Calculation

How To Calculate Wages 14 Steps With Pictures Wikihow

How To Calculate Wages 14 Steps With Pictures Wikihow

Hourly Rate Calculator

Hourly Rate Calculator